Manufacturing IT Execs Push Ahead with Industry 4.0 Tech

Introduction

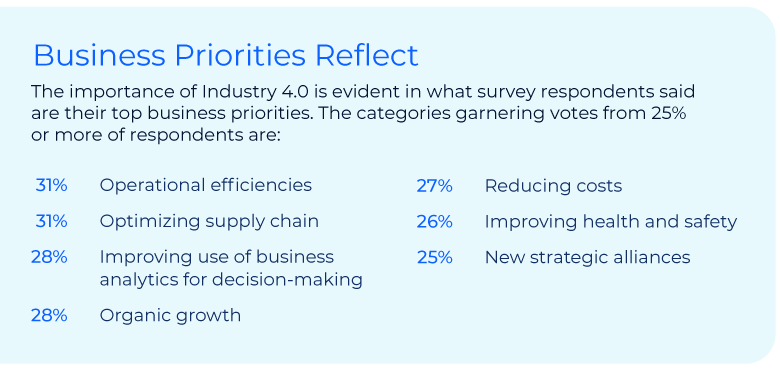

Industry 4.0 was in full swing in manufacturing companies before the pandemic and continues unabated, as top business priorities for the sector include improving operational efficiencies, optimizing supply chains and improving the use of business analytics for decision-making. And manufacturers are counting on technology to help them achieve those goals, including Internet of Things (IoT), robotics and automation, digital twins, AI and ML.

These are some of the top-line results from a recent survey of more than 200 IT executives in manufacturing companies. The survey, conducted by DemandScience in collaboration with Comcast Business, shows many of the priorities are intertwined. The goal of improving operational efficiencies, for example, will rely on improved use of analytics. And most all the priorities in some form feed into a goal familiar to companies in any industry: minimizing costs.

To meet their priorities, manufacturers expect a number of technologies will play a crucial role, including Internet of Things (IoT), robotics and automation, digital twins, artificial intelligence (AI), and machine learning (ML).

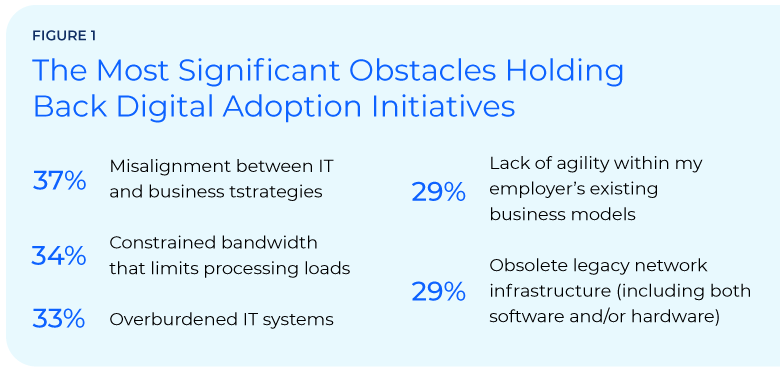

The Industry 4.0 journey is not without its challenges, however, including a misalignment between IT and business strategies, and a lack of agility. They also face network problems including bandwidth constraints, reliability issues and obsolete infrastructure.

None of these issues are insurmountable, however. In this paper, we’ll examine both the priorities and the challenges, while highlighting the technologies and supporting infrastructure manufacturers expect will help them overcome those challenges and meet their goals.

Goals such as increased efficiency, optimization and improved use of analytics are all foundations of Industry 4.0, which is all about putting all the computers and networks of the Industry 3.0 era to more effective use.

Survey respondents’ priorities reflect an intention to do just that. In fact, many are intertwined. “Improved analytics” for example, will likely play a role in meeting all the other goals, as manufacturers seek to put data to effective use in all corners of their businesses. Similarly, operational efficiencies will lead to reduced costs and forging new strategic alliances will help promote growth.

The Manufacturing Technology Picture

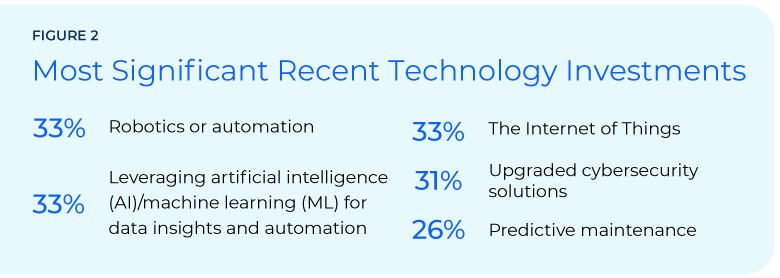

The drive to Industry 4.0 is even more evident in the choices of technology that manufacturing IT execs are planning to implement.

Leading the way is IoT technologies, cited by 41% of respondents. IoT includes all the sensors and instrumentation that is driving the smart factory of the future. It plays a role in numerous other technologies in which manufacturers are interested as well, including robotics and automation, cited by 35% of respondents (tied for second with upgrade cyber security solutions).

Together, IoT and robotics/ automation go a long way toward helping manufacturers deliver on the smart factory. Two additional and related underpinnings cited by respondents include:

29%

Leveraging artificial intelligence (AI) and machine learning (ML) for data insights and automation

27%

Predictive maintenance

Predictive maintenance relies on IoT technology such as sensors as well as AI/ML to optimize maintenance in manufacturing. Not long ago, machines were maintained strictly according to a calendar-based schedule – whether they needed it or not. Predictive maintenance enables AI/ML algorithms, working from an established baseline of “normal” behavior, to identify when a machine is straying from that baseline, and thus needs attention. Maintaining machines only when they actually need it promises to deliver big operational savings for manufacturers, while also promoting improved reliability and uptime.

Nearly a third of respondents (30%) also expressed interest in digital twin technology. Digital twin also holds great promise to help manufacturers cut costs and increase efficiency with its ability to represent physical systems in software. Companies can then conduct what-if scenarios on the software model to determine, for example, what effect a change to the operating speed of a machine will have on the finished product – without the risk of actually making the change to the physical machine.

These are some of the same technologies included in Gartner’s top 10 trends in manufacturing back in 2019. Given Gartner’s tendency to be well ahead of the technology curve, that means they are just now factoring into plans for most manufacturing companies. Digital twins, analytics, and autonomous things/robotics were all featured on that list. They are also foundational technologies for trends Gartner continues to site, including the smart factory concept and product personalization.

Facing Down Technology Obstacles

Manufacturers do face obstacles in implementing digital Industry 4.0 initiatives, some of which have to do purely with technology while others are more management-oriented (see Figure 1).

As with the business priorities, many of the challenges are interrelated. Obsolete network hardware and software, for example, won’t be able to support the high speeds inherent in the latest wired and Wi-Fi networking standards. That can lead to bandwidth constraints that limit processing loads, an issue cited by more than a third of respondents.

Too heavy a reliance on public internet networks, especially when combined with that obsolete network infrastructure, will lead to unreliable wide-area connectivity, cited as an issue by 27% of respondents.

Use of disparate networks, cited by 25% of respondents, is a close cousin to obsolescence. It reflects piecemeal efforts to address issues over the years, likely including operational technology (OT) network infrastructure, resulting in different networks that don’t seamlessly talk to one another.

The disparate network issue can also be viewed as a management-oriented challenge that reflects the need for an overarching architecture to drive technology decisions. Today, that includes the need to integrate IT and OT networks in order to fully capitalize on Industry 4.0 initiatives. Two other obstacles also fall into the management challenge camp: misalignment between IT and business strategies, and overworked IT teams.

Overworked IT teams are largely a fact of life in almost every vertical, with IT talent at a premium. Adopting managed offerings is a viable solution (more on that shortly).

The misalignment issue is likely reflective of a situation where the business establishes a priority but neglects to put IT budget behind it.

Manufacturing Technology Imperatives

Survey respondents are apparently getting the message, as many of the items they identify as their top recent technology investments map well to meeting the requirements ahead of them (see Figure 2).

These investments will help manufacturers in their quest to create smart factories, which will be a requirement to delivering on some of the leading-edge technologies that experts including Gartner say manufacturers should be addressing in the years ahead, including:

- Augmented and virtual reality (AR/VR). Such technologies make possible immersive experiences that speed up product design and development processes. They also enable in-depth employee training with a realistic “hands-on” but risk-free environment.

- Augmented analytics will require use of machine learning and IoT technologies to analyze production data more quickly, to drive more speed and efficiency in operational decisions.

- Product personalization, which will require manufacturers to implement technologies including online product configurators, recommendation engines, 3D scanning and modeling, smart algorithms that support dynamic pricing, and flexible production software.

- Autonomous mobile robots and other robotic applications will require use of AI to support automated processes, contributing to the evolution of smart factories.

Smart Factories Require a Sound Tech Foundation

All of these initiatives will require a strong technology foundation built on fast, reliable, secure networks.

It starts with plenty of bandwidth within the facility, both wired and wireless. That means supporting the latest networking standards, such as Wi-Fi 6. Wi-Fi 6 offers about a 30% to 40% speed boost over previous generations, around 10G bps, and better performance in congested areas like factory floors.

Such fast, reliable networks are a fundamental underpinning of a smart factory. They’re required to support connections for latency sensitive applications such as robotics, and to connect the edge computing infrastructure that supports AI and many other manufacturing applications.

Similarly fast and reliable wide-area networks are required to connect manufacturing facilities to other company sites as well as to the various cloud services that are increasingly part of the mix.

Options such as software-defined wide-area networking (SD-WAN) may well come into play. SD-WAN offers a more flexible wide area versus legacy networking, including application-aware traffic routing and segmentation so IT teams can prioritize important applications with adequate bandwidth. It also enables IT to more easily analyze traffic patterns to better fine-tune their network. And it works with whatever network underlay is the best fit for each location, including public internet connections, dedicated Ethernet and 5G cellular.

Strong cybersecurity is also crucial to help protect all network and IT infrastructure, so it’s not a surprise to see survey respondents upping their investments in that area. As manufacturers seek to unite their IT and OT environments, those once-closed OT networks may become internet-connected for the first time. That opens up a number of new potential entry points for cyber intruders.

The good news is security capabilities are often now provided along with network services, either on an as-a-service basis or built into the same equipment that provides network connectivity (or both). That helps makes security easier to implement and manage, a key consideration for manufacturing facilities that may not have full-time IT and security experts on hand.

Manufacturers need a fast and reliable network to help their facilities maintain daily production flows and smooth supply chain operations. Comcast Business can deliver scalable network solutions.

Learn more at https://business.comcast.com/manufacturing

Technology plays a critical role in helping manufacturers meet their efficiency goals

Locked Content

Click on the button below to get access

Unlock NowOr sign in to access all content on Comcast Business Community

Learn how Comcast Business can help

keep you ready for what's next.